Latexo ISD Adopts FY 2019 Budget

Tax Rate Remains Unchanged

By Will Johnson

Messenger Reporter

LATEXO – The Latexo Independent School District has a new budget for Fiscal Year (FY) 2019 and it’s based on the same tax rate as last year.

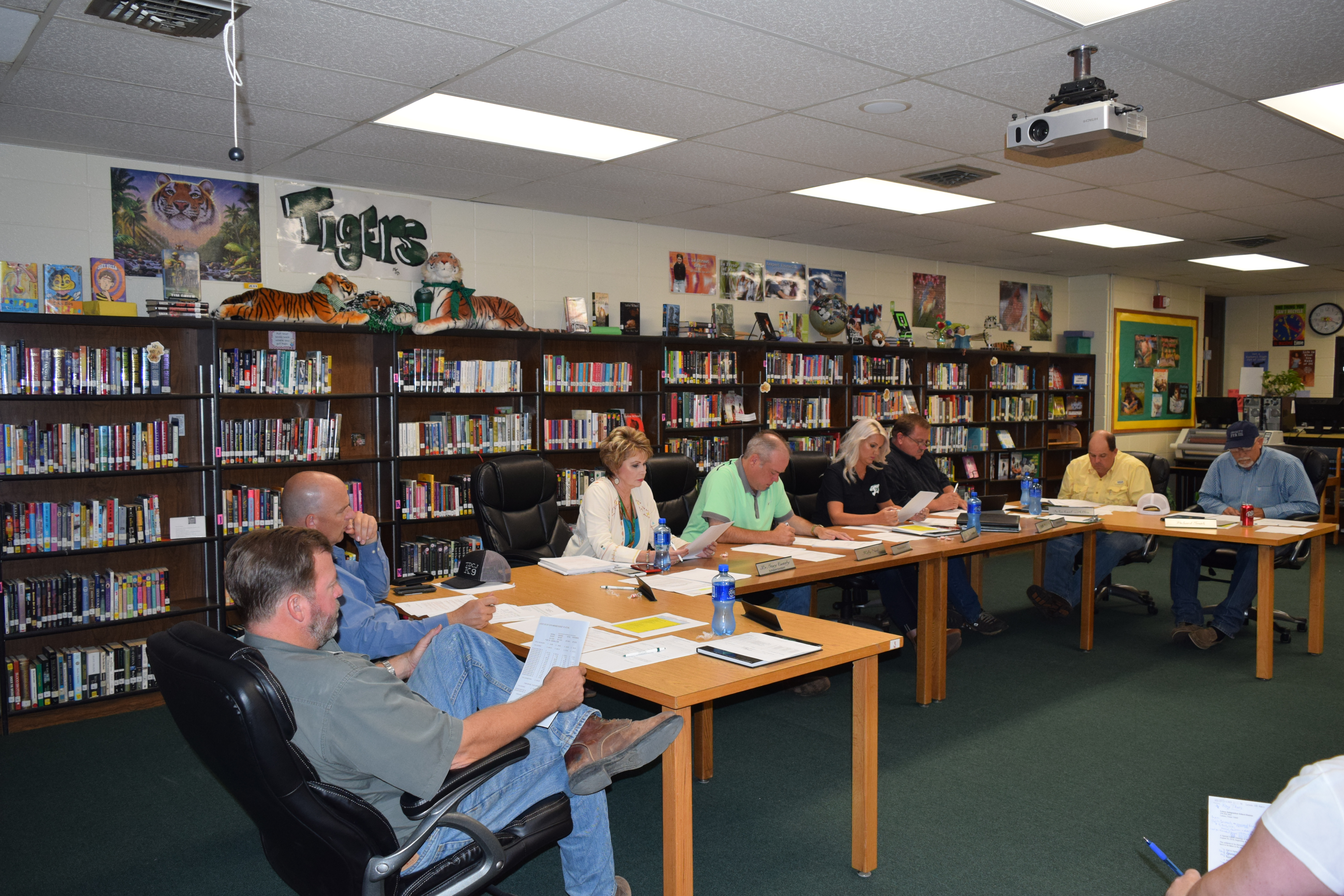

As a meeting of the Latexo ISD Board of Trustees got underway on Thursday, Aug. 30, LISD Board President Kelly Nicol opened a public hearing on the proposed budget for the 2018-2019 school year. No one spoke in favor of or against the district’s financial blueprint so – after 15 minutes – the hearing was adjourned.

A second meeting was convened shortly afterwards as the trustees began discussions on the actionable items on the meeting agenda.

The first order of business pertained to an agreement with the Houston County 4-H.

LISD Superintendent Dr. Stacy Easterly explained each year the district and the Houston County 4-H entered into an agreement where the Houston County extension agents are listed as adjunct faculty for a period of time listed on the agreement.

“The adjunct professors would be Jo Smith, Mandy Patrick, and Corey Hicks. I recommend we approve this for the adjunct professors for 4-H,” she said.

A motion was made to that affect, seconded and was approved unanimously.

Following the 4-H discussion, the board turned to the district’s financial matters. The first area addressed concerned a budget amendment to the FY 2018 budget.

“This amendment just switches money around for other purposes. We do this every year,” LISD Business Manger Jo Lane informed the board. “We have to keep enough money in Function 11 where if our auditors come in and have to make some journal entries, that’s where it is. It did not change the bottom line.”

The budget amendment was approved as presented. This was followed by a discussion on approving the final amended budget for 2017-2018. The district’s final amended budget reflected an amount of $5,420,057.

Once the FY 2018 budget had been finalized, the board tackled the FY 2019 budget.

“This is the final ’18-’19 budget. It includes the general fund, food service and debt service because that is what we are required by law to approve. Last year’s budget was $5,420,057 while this year’s is $4,903,320,” Lane said.

The difference between the FY 2018 budget and FY 2019 budget is $516,737. Both Easterly and Nicol stressed the budget cuts from 2018 to 2019 did not contain any cuts to instruction within the district.

Following a lengthy discussion about the coding of security, the FY 2019 budget was approved by the LISD board.

Once the FY 19 budget was adopted, the board turned its attention to setting the FY 2019 tax rate. The FY 2018 tax rate was 1.204000 and in FY 2019, the proposed tax rate for LISD did not change.

The tax rate reflects $1.04 used for maintenance and operations (M&O) costs while $0.164 will be used for interest and sinking (I&S). The M&O rate refers to the amount of money needed by an entity for operations on a day-to-day basis, while I&S refers to debt service.

The LISD board unanimously approved setting the FY 2109 tax rate at $1.204000

In other matters brought before the board in open session:

- An interlocal agreement with Region VI was approved.

- The 2018 tax roll from the Houston County Appraisal District was approved as presented.

Will Johnson may be contacted via e-mail at [email protected].

5