Local CPA Foresees Positive Local Impact From GOP Tax Bill

By Sarah Naron

Messenger Reporter

With the GOP tax bill set to become law Monday, Jan. 1, many taxpayers are likely questioning exactly what changes they can expect to see and how the new rules will affect their local area.

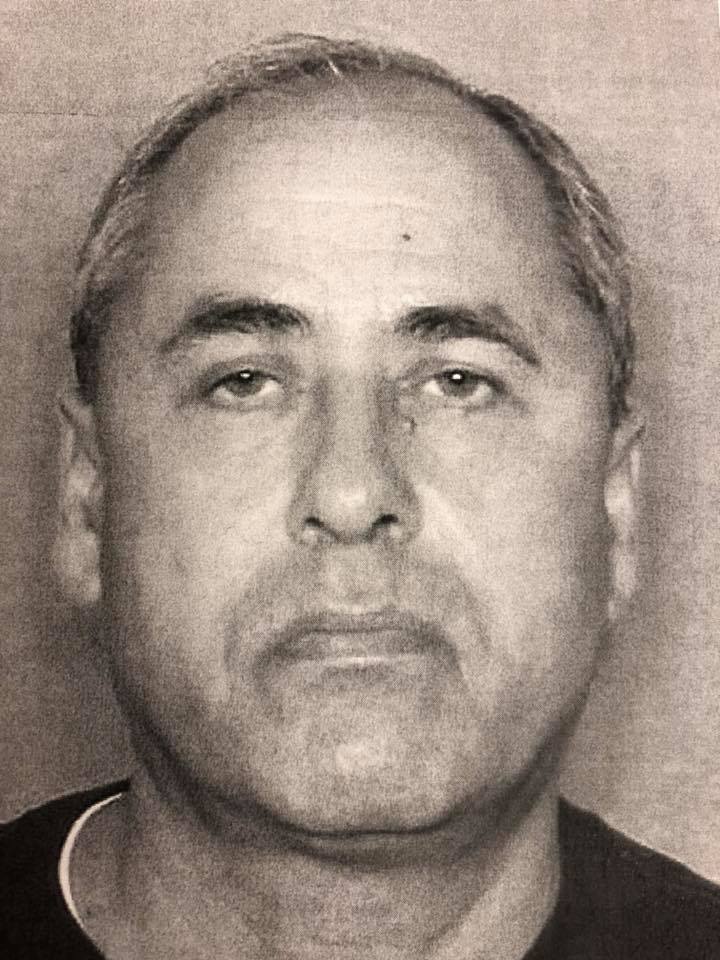

According to local CPA Jack Coleman, much of the bill will have a positive impact on the people of Anderson and Houston Counties.

“Property taxes is one of the things that has been a big concern for a lot of people – they don’t understand it,” Coleman pointed out. “That limitation that’s being discussed is the $10,000 limitation that applies to itemized deductions. Property taxes paid on businesses are going to be fully deductible.”

According to Coleman, a few people in Houston County can expect to be impacted by the new property tax rules, but many will remain unaffected.

“It will be (effective) only if the property taxes exceed $10,000,” he explained.

Coleman also spoke on the decision made by Congress to leave the child tax credit in place.

“(That’s) one of the things that I think a lot of people miss, which is a real plus for our area,” he said. “That had been negotiated out, and then, Sen. Cruz got it back in there kind of at the last minute.”

As Coleman explained, the child tax credit is not only based on the income level of families with children under the age of 16, but it is also refundable.

“In other words, if each child is worth $1,500, that applies back to their income as a refund even though they didn’t pay anything in,” he said. “A family with two children that qualify – that’s $3,000 per household that pumps back into those households that nobody ever paid in.”

Coleman views this as a large perk for the local economy, as many residents of Houston and Anderson counties qualify for the credit due to their income levels.

The new laws will also bring changes to alternative minimum tax.

“Under the old alternative minimum tax rules, the limitation on that, or the threshold for that triggering was about $40,000 in excess deductions and tax preference items,” explained Coleman. “That has been moved to $100,000 dollars.”

As Coleman pointed out, many families in the local area have large numbers of children, each of which hold “a fairly high value of an exemption amount.

“As a result, they (the families) hit that $40,000 limit, and it would trigger a little bit of alternative minimum tax,” Coleman said.

“That could help out a fairly large number of people, especially if they’re making enough money to be able to afford a house, itemize their deductions, and then have a relatively large family,” Coleman said in reference to the raising of the threshold.

“It’s a very family positive type approach that I think has been taken on it, and I’m not saying that from a political standpoint,” he continued. “It’s just I know that has been an issue with some families in the past. I was seeing that in my own tax practice four and five years ago.”

It is clear that some portions of the new tax rules, according to Coleman, cannot be judged as a positive or negative impact on the local area until they have been in place for some time.

“One of the things I don’t know about – and I’m assuming that the rate calculation is going to be the same as it has been because it favors investment activity – is that there had been a provision in there if your income level did not trigger federal income tax – in other words, you had a zero tax bracket on regular income tax – your capital gain rate would compute to be zero as well,” he said.

Coleman explained that this rule is beneficial to retirees who have made investments in the past “and are collecting a note or something like that where there’s capital gains associated with it.

“I’m not real sure on that, but I’m fairly certain from what I’ve read and understand that that is still in place,” he said. But that’s one of them that we need to wait to see what the final rules are before we jump off and say, ‘Okay, we’re going to sell something.’”

Coleman advised against selling any investments before the rules are published.

“If you can hold off until February, then that would be a good time to really understand it, if that was a particular interest,” he said. “I know that the rates have stayed the same.”

Coleman also praised the new tax rules for the relaxation that has been placed on the tax rates associated with small businesses.

“Somebody can go into business for themselves and be able to earn enough money to make a living wage as a sole proprietor before the government gets in there and starts taking so much of their working capital out,” he explained. “It leaves that money in that business so that the business can continue to expand. Expanding businesses create a large number of employees.

“I think that’s kind of moving back away from the tax code favoring really large scale business operations. It’s back to where it favors the working guy,” he continued. “There is a sense that the blue-collar guy is being taken care of in this whole tax plan.”

Overall, Coleman’s opinion on the new rules is a positive one.

“All these things create opportunity. If you create opportunity, people are going to take advantage of it, and it could get us growing a little bit,” he said. “That’s what we desperately need here in Houston County, Anderson County – everywhere in East Texas – so we can move commerce back into our area rather than exporting our labor force to the bigger cities.”

Sarah Naron may be reached via email at [email protected].