Commissioners Court Lowers Proposed Tax Rate

By Will Johnson

Messenger Reporter

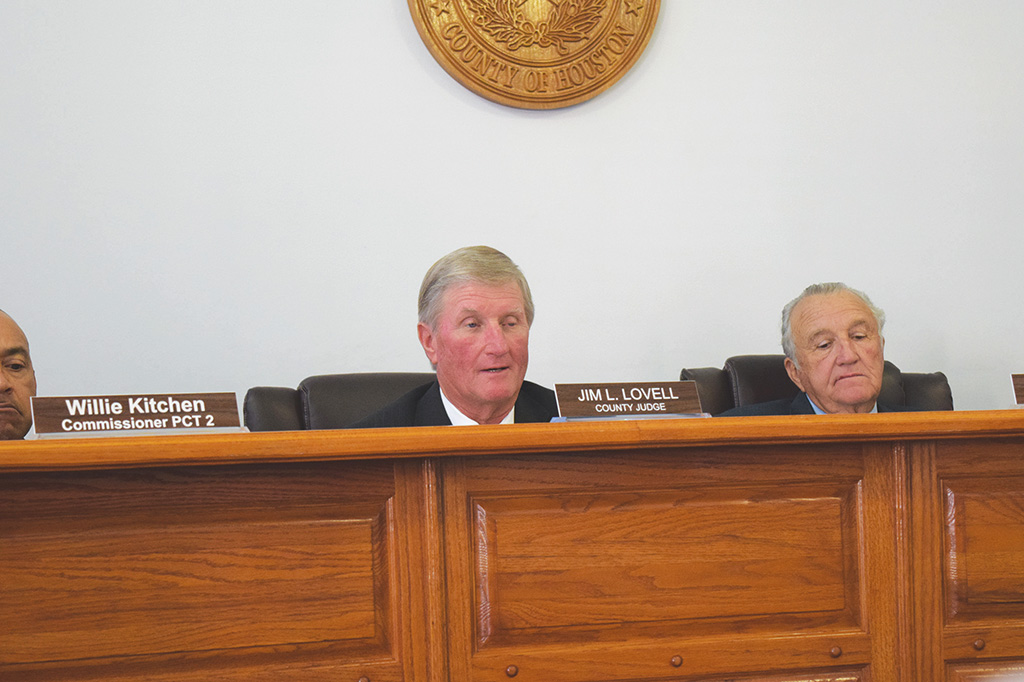

HOUSTON COUNTY – The Commissioners Court of Houston County lowered the proposed tax rate by one cent during a court session held on Tuesday, Aug. 22.

During a meeting held on Tuesday, Aug. 8 the commissioners had proposed a tax rate of 0.55 per $100 of property value. As the Aug. 22 meeting got underway, County Judge Jim Lovell said the court had revised the proposed rate.

“We have worked on this some more and we were able to actually lower the proposed rate to 54 cents per $100 of property valuation. That brings us to a little over one and a half cents of increase,” he said.

The county currently has a tax rate of $0.524 per $100 of property valuation. The effective tax rate for the county has been set at $0.523691 and the rollback rate has been set at $0.706181.

According to Section 26.16 of the Texas Property Tax Code, “The effective tax rate is the rate that would generate the same amount of revenue in the current tax year as was generated by a taxing unit’s adopted tax rate in the preceding tax year from property that is taxable in both the current tax year and the preceding tax year. The rollback tax rate is the highest tax rate a taxing unit may adopt before requiring voter approval at an election.”

Lovell asked for any comments on the new proposed rate and a citizen who requested not to be identified spoke up and addressed the court.

“I’m just here to urge y’all to vote against the increase. I’m retired and my income doesn’t increase. I get the same income every month. I moved up here to retire and not to spend my money on tax increases. This makes the fourth year where y’all have gone up on the tax rate since 20143. This is the third year in a row,” she said.

“Enough is enough,” she continued. You can’t saddle the taxpayers with every little tax increase that comes along. Obviously, I’m the only one taxpayer who cares enough to be concerned. It seems like the whole county is complacent or they’re not aware of what’s going on or they just don’t care.”

The judge replied there were several reasons for the proposed tax increase.

“There are a lot of unfunded mandates approved by our legislature. They come up with some ideas and pass a law but don’t give us any money to implement them,” he said.

He gave an example about a recent law which was enacted which required the jail to have a psychologist on staff at all times.

“We are able to do that with video, but it will cost us $11,000. That’s just one example,” Lovell commented.

Other reasons cited by Lovell included funding for indigent defense court cases and a loss of revenue from timber.

“I understand all that,” the concerned resident said. “But when we pay taxes, we expect to see the return on our tax dollars. Taxpayers are not seeing any return on their tax dollars. We bought our property back in 2008 and our county road is not any better today than it was in 2008.”

As the meeting continued, County Tax Assessor Danette Millican commented the lowering of the proposed tax rate would cause a significant loss of revenue for the county.

“If you lower the tax rate by one penny, and you have a property with a taxable value of $1,000, it save the tax payer $10 per year. If you lower it, it will cost the county $127,000,” she said.

Following the tax assessor’s comments, a motion was made, seconded and unanimously approved to set the proposed tax at $0.54 per $100 of property value.

Public hearings on the proposed tax rate will held on Sept. 1 and Sept. 5 at 8:00 a.m. The tax rate is expected to be adopted on Sept. 12.

In other matters brought before the court:

• The commissioners approved the minutes from previous meetings.

• The payment of bills and expenses incurred by the county were approved.

• The Houston County Treasurers Report, Compensatory Report and annual road reports were received as information by the commissioners.

• The court approved the salaries for a part-time jailer and an IT technician.

• A motion was approved to renew the Affordable Care Act Reporting and Tracking Service through the Texas Association of Counties.

• Hotel Occupancy Tax funding was approved for use in the amount of $3,000 for use by the Grapeland Chamber of Commerce in promoting the 2017 Peanut Festival. The commissioners also approved $1,000 for use by the Crockett Lions Club in supporting the Lions Club Golf Tournament at Spring Creek Country Club.

Will Johnson may be reached via e-mail at [email protected].